Harshad Mehta Scam- How one man control entire Dalal Street?

Here are some tactics :-

1. Bank receipts : He exploited the loophole in the bank system that allowed the issuance of fake bank receipts. He used fake receipts as collateral to got loans from banks and use that money to buy stocks.

2.Inside trading :- Mehta has reach to inside information, which he used to make informed investment decisions before the public was informed of the information.

3. Circular trading:- Mehta active in circular trading, which helps him to selling and buying the same shares for fake demand and increase their price.

4.price rigging :- Harshad would fake increase the cost of stocks by buying large quantities of stock in the market , after that he spreading false rumors about the companies to attract other investors.

Its harm to the Indian financial system. Its exact amount of financial loss is difficult to estimate, but it is approx. Rs.4,000 crores ($800million)at that time.

The Harshad scam to loss of public trust in the financial system and exposing weaknesses in the regulatory framework. The Indian government responded by introducing new regulations of the banking and financial sectors.

Who caught the fraud of Harshad Mehta

Sucheta Dalal and Debashis Basu began investigating irregularities in the stock market in 1991,and their research led them to Harshad Mehta , Sucheta and Debashis spend months gathering information to taking the sources and studying financial documents to understand the nature the scam. After the hard work one of the key pieces of evidence that the use of bank receipts by Harshad Mehta. They published a series of Articles to exposed the Harshad fraud in Times of India in 23 April1992.

After long time :

Harshad Mehta arrested on 9 November 1992 by CBI .After gathering evidence the CBI filed a case against Harshad Mehta and his association on23 October 1992,charging them with cheating ,Criminal conspiracy , and forgery.

About Harshad Mehta:

He was born on July 29,1954. He came from meddle class Gujarati family. His journey as a stockbroker in the late 1970s. He worked for a broker age firm in Mumbai before starting his own firm called “Grow more Research and Asset Management”. he passed away on December 31, 2001,due to a heart attack.

He is known as Amitabh Bachchan .

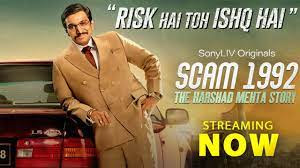

A webseries is also released on the Harshad Mehta:-

SCAM 1992

Comments